From new pop-up stores to great exhibitions – our LMH Luxe List rounds up what’s on our to-do list in London for the month of July…

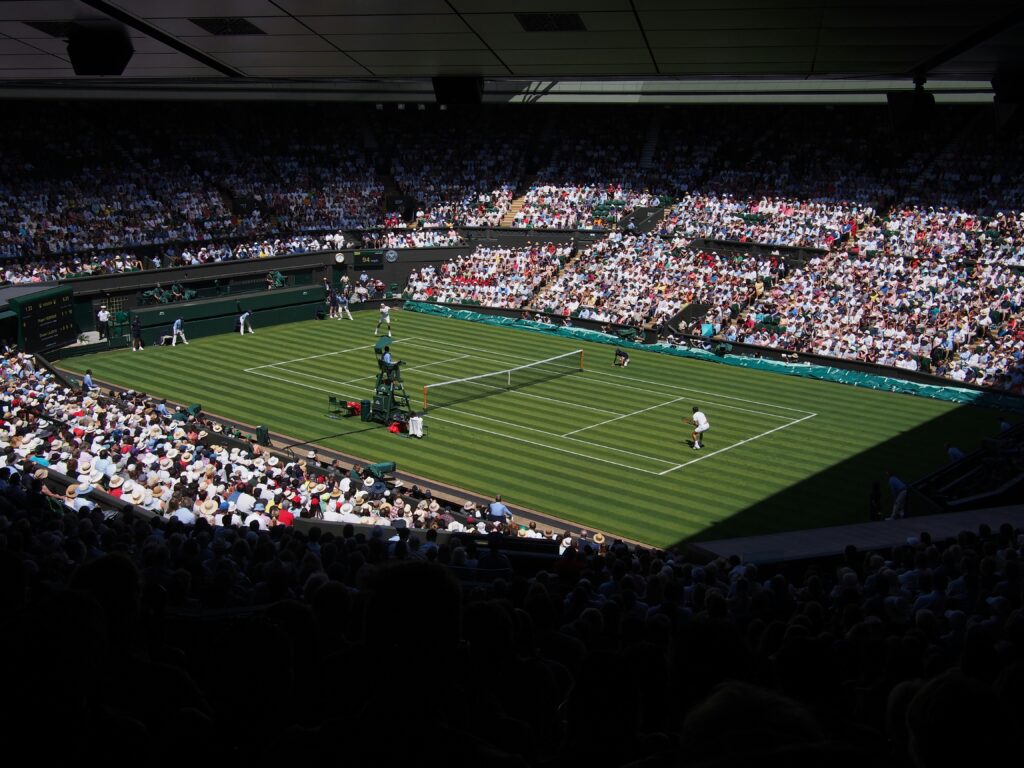

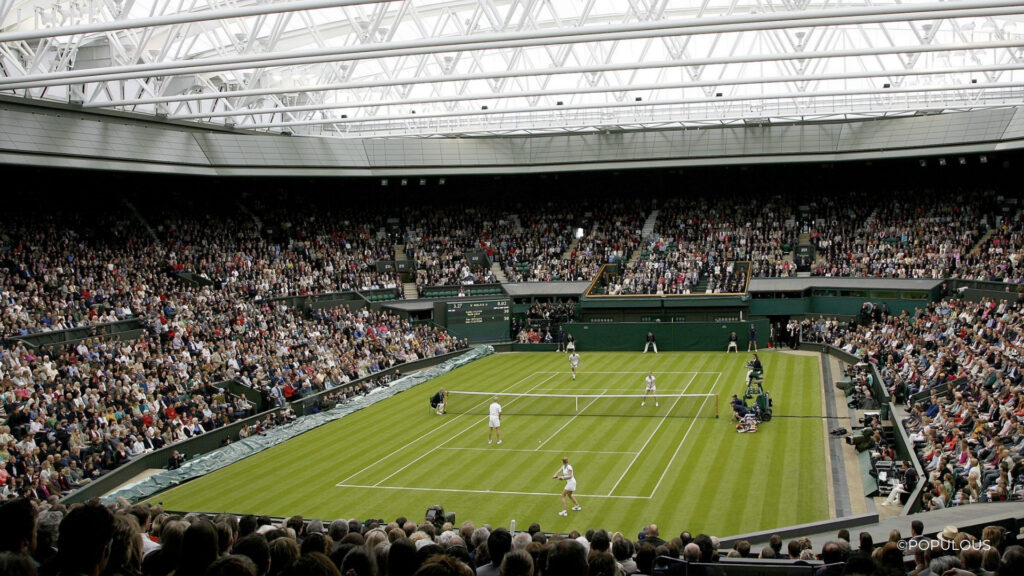

The Event: Wimbledon

The pinnacle of summer sport returns from Monday, 30 June to Sunday, 13 July 2025 at the All England Lawn Tennis & Croquet Club. Expect top-tier tennis, quintessential British fashion (hello, strawberries & cream) and the famed on-court Debenture hospitality. Whether securing Centre Court seats or enjoying a Pavilion Box experience, Wimbledon remains the ultimate summer social must-do.

30 June – 13 July, All England Lawn Tennis & Croquet Club

The Exhibition: Buckingham Palace State Rooms

From 10 July to 28 September 2025, the famed State Rooms at Buckingham Palace open once again for public viewing. It’s a rare opportunity to step inside the ceremonial heart of the British monarchy – 19 rooms used for official occasions and royal receptions, each adorned with priceless art from the Royal Collection, including works by Rembrandt, Rubens and Vermeer. Visitors can wander through the White Drawing Room, the Throne Room and the Ballroom, where state banquets take place under glittering chandeliers. This year’s summer opening also includes access to the Palace Gardens, a tranquil escape featuring more than 350 types of wildflowers. An unforgettable glimpse behind the gilded curtain of royal life.

10 July – 28 September, Buckingham Palace

The Restaurant: Soleil by Claude, Belgravia

New for summer, Soleil by Claude uplifts The Peninsula London terrace in Belgravia. Open 2 July – 31 August 2025, this Mediterranean-inspired rooftop destination celebrates laid‑back charm with dishes like Polpo Carpaccio, seafood platters, seven‑hour braised lamb shoulder and salt‑crust sea bass. Expect golden‑hour Spritz, weekend DJs, pétanque and sweeping skyline views – a perfect July dining escape.

Opening 2 July 2025

The Pop-Up: Aurélien at Selfridges – “Quiet Luxury” Footwear

Opening in July and running through August, Aurélien’s Selfridges pop-up introduces refined Mediterranean-style yacht loafers, knit sneakers and premium suede styles. Known for strong craftsmanship and minimalist elegance, the brand’s limited-edition “quiet luxury” pieces make for exclusive summer wardrobe additions.

July – August, Selfridges, Oxford Street, London

The Collection: Lewis Hamilton × Dior – Afrofuturism Capsule

Launching 3 July 2025, Formula 1 icon Lewis Hamilton joins forces with Dior Men’s artistic director Kim Jones for a groundbreaking capsule collection titled Afrofuturism. This limited-edition line blends high fashion, cultural heritage and progressive design through the lens of African futurism. Featuring tailored leopard-print tweed shorts, deconstructed hooded jackets, sculptural blazers, velvet boots and embossed monogram bucket hats, the collection redefines the future of luxury menswear.

Launching 3 July 2025